Insurance – one of the most common terms heard in today’s world. I opine that it should be one of the basic necessities of human life like food and shelter.

What is Insurance?

Insurance is the transfer of risk of any kind from an individual to the insurance company. The insurance company is liable to pay the costs related to the risk you have gotten yourself secured for. Hence, when you get insured, you have a self-security and your family is secured as well. There are many different types of insurance that account for security.

Now, you must be wondering why will the insurance company pay for my risk? Well, that’s because, when you get the insurance you pay an amount known as “premium” to the insurance company. Based on this premium, you obtain a pre-approved amount or “sum-assured” up to which the company is liable to cover all the costs incurred.

Confused? Don’t worry… Let me tell you what “premium” and “sum-assured” mean.

Premium is a payment you make to the Insurance Company on a monthly, quarterly, half-yearly, or yearly basis for securing you and your family.

Sum-Assured is the amount the Insurance Company pre-approves for you and pays you at the time of the happening of the event you purchased the insurance for.

For example, if you pay INR 10,000.00 as premium and your sum-assured is INR 10,00,000.00 for Home Insurance. So, the time when there are untoward happenings like fire breakout or theft at your home, the Insurance Company will cover up to INR 10,00,000.00 of the loss incurred. Any amount below INR 10 lacs will be covered by the Insurance Company and the difference in any amount above INR 10 lakhs will be incurred by the owner of the home. Hope this explanation helps in understanding the basics of Insurance.

Every day, we hear many cases of people having to face death untimely. Teenagers as young as 18 years old are dying as a result of dreadful diseases like cancer which can be cured but isn’t due to lack of financial resources. Your dream car meets with an accident and is left to shatters for months owing to the insufficient cash flow. With the increasing number of theft and burglary cases every day, thousands of people become homeless due to the paucity of available resources to be able to acquire everything again. Life is uncertain, so we should always be ready for whatever we might have to encounter. Insurance is the saviour in all these situations and can thus be considered the guard to the uncertainties of life!

Anxious about what will happen to your family if you ever need to face any physical disability or an unfortunate mistimed death? This is where insurance comes to the rescue! Yes, if you have insurance, you can be carefree! How? – Insurance will take care of the needs and expenses of your family, no questions asked while you focus on a speedy recovery.

Here are some advantages of getting an Insurance:

- Car accident damage expenses are covered

- Health and hospitalisation costs will be paid back

- Home theft and burglary losses can be indemnified

Now, let’s dive deeper into the different types of insurance you can buy to secure yourself, your family, and property:

- Health Insurance

- Life Insurance

- Automobile / Vehicle Insurance

- Accidental / Disability Insurance

- Property / Home Insurance

1. Health Insurance:

Health Insurance is an insurance that covers your medical expenses. It is important because healthcare is the sector which undergoes the highest rate of inflation every year.

All kinds of medical and surgical expenses, (including the costs of medicines) of the insured person are covered under their Health Insurance by the company a person has purchased the insurance from.

For instance, a surgery that cost INR 50,000 in 2010 costs INR 5,00,000 in 2020. With this massive inflationary gap, arranging such a big amount can be a matter of life and death for most of the people. This is where Health Insurance steps in. With the payment of a minimal amount of premium, you can get covered for a big hefty amount of medical bills and not worry about having to arrange funds in the eleventh hour.

Health Insurance makes sure that you focus on the health of your loved ones while the Insurance Company pays your medical or surgery bills to the hospital directly or by reimbursing the money to the bank account of the insured individual.

2. Life Insurance:

Human life is the most important asset. Therefore, securing life insurance is considered an investment as unlike other insurance policies, this offers a heavy compensation in case of:

- the premature death of the insured individual or;

- after the expiration of a certain time period, that is, the time period mentioned in the Insurance Documents or;

- when the earning capabilities of the insured individual come to a limit due to age and increasing illnesses.

- Without life, any amount of wealth is useless. In order, it is advised to invest some of the wealth in life insurance.

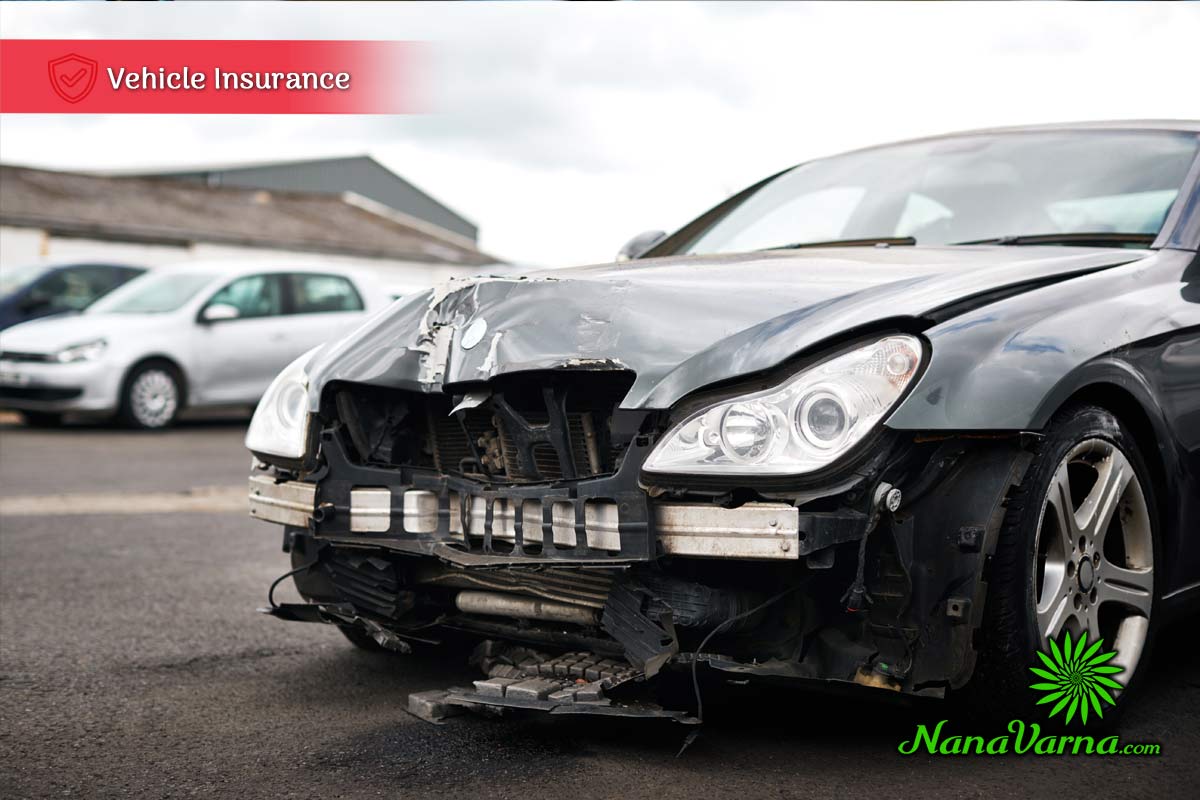

3. Automobile/Vehicle Insurance:

Automobile or Vehicle Insurance is the Insurance Policy purchased by automobile owners. It is generally bought at the time of the purchase of a new vehicle.

Just like life insurance and health insurance that cover for the personal and medical expenses of the insured individual, an Automobile or Vehicle Insurance can be considered as Life Insurance for vehicles. It covers the expenses required for the purchase of your automobile in case it meets with an accident and needs major repairs. Generally, fully or most of the expenses are covered by an Automobile Insurance.

It also covers the cost of your vehicle in case it undergoes theft or burglary. Not only that but also the treatment costs arising out of an injury are also covered, where the owner is looked after.

Car repairs and maintenance can be quite expensive and it’s always suggested to get an Automobile Insurance for your vehicle. The premium paid for an Automobile Insurance depends on a lot of variables such as driving insurance, vehicle type, vehicle cost, and the region where the vehicle is driven.

4. Accidental/Disability Insurance

Accidents are unpredictable. Especially, in India, where there is extensive road-jamming traffic every day. According to a survey, approximately 1200 people face a road accident every day in India. A road accident can seriously injure any part of the body or is sometimes fatal. Consequently, Accidental / Disability Insurance is a must.

It covers all kinds of accidents and injuries, partial and full disabilities, or even permanent and temporary disorders. Accidental insurance is also cheaper to buy when compared to Life and Health Insurance, yet covers the complete loss and protects your life from setbacks.

5. Property/Home Insurance

One of the most valuable necessities of life is – Home. It is a property that is treasured and priced the most. But, natural calamities such as storms, cyclones, floods, or man-made mishaps such as theft, terrorism, riots, burglary, etc., can create a loss to your property. That’s right where Home & Property Insurance takes its form!

A Home Insurance protects the physical structure and the contents of your home from all artificial and natural disasters that can damage your home and leave you destitute where you might be forced to go in for boarding and lodging. In such a case, home insurance covers your lodging expenses.

Home Insurance is essential since shelter or housing is a basic need for life and safeguarding our home from all kinds of precariousness must be our priority. After all, home is where we recall our memories of life, and losing that place would be terrible!

So, what are you waiting for? Get a Home/Property Insurance now.

Having got to know the varied insurance policies, the next thought is on deciding the best Insurance Company. Wondering which one to choose? No frets…. It’s not that strenuous!

Here are a few things that you must look for while choosing a policy:

- Premium Paid

- Sum Assured

- Waiting Period

- Exceptions

- Claim History

- Claim Bonus Every year

- Uncertainties Covered

The above terms vary according to the policy products of an Insurance Company. However, the best option would be to go with the company that has a good track record in Claim History and the Sum Assured has a higher ratio in comparison to the Premium Paid with a least Waiting Period. It is suggested that you go through the terms and conditions of all the types of insurance you are purchasing to protect your life and check the exceptions and unpredictabilities covered by each company.

In today’s world, Insurance plays a crucial role in governing our lives. Paying a minimal amount of premium to the Insurance Company every year is better than struggling to find sources of funds during times of need!